Description

In trading and portfolio management, correlation refers to how similarly two assets move in relation to one another. This indicator provides a simple but powerful visual reference that measures the strength and direction of correlation between the current chart symbol and up to eight other assets of your choice.

Understanding these relationships helps traders and investors:

- Avoid entering trades in highly correlated instruments, which could amplify risk unintentionally.

- Spot opportunities across related symbols, such as entering inverse positions or taking advantage of temporary divergences.

- Diversify portfolios more effectively, by including instruments with low or negative correlations.

The indicator uses a correlation coefficient to quantify relationships:

- 0.0 = no correlation

- +0.3 = low positive correlation

- +0.8 or higher = strong positive correlation

- –0.3 = low negative correlation

- –0.8 or lower = strong negative correlation

For example:

- EURUSD and GBPUSD often show high positive correlation, moving in the same direction.

- USDJPY and gold may show negative correlation, where one rises while the other falls.

This tool displays these values in real time, updating with each bar and reflecting recent price behavior based on a user-defined correlation period. You can control how far back the indicator evaluates and how many bars it uses for its correlation calculation, giving you flexibility based on your strategy or timeframe.

It’s ideal for manual traders managing multiple symbols, as well as anyone looking to build risk-aware, non-redundant portfolios.

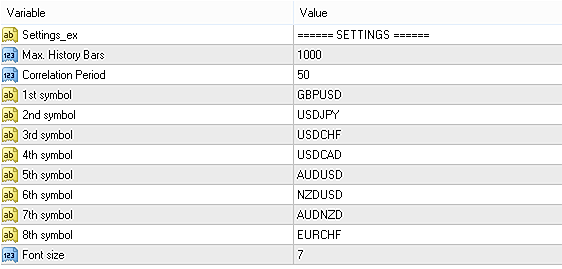

Input Parameters

- Max History Bars – Number of past bars to evaluate when the indicator loads

- Correlation Period – Number of bars used in the correlation calculation

- 1st Symbol to 8th Symbol – Input the tickers you want to measure against the current chart symbol

What to Expect

This indicator is a decision-support tool, not a trading signal generator. It provides quantitative feedback on symbol relationships so you can avoid overlapping positions, diversify efficiently, and take advantage of statistical movement patterns across your trading portfolio.

Once loaded on a chart, it continuously updates correlation data tick by tick, offering live insights into how instruments are behaving in relation to each other.