Description

The PZ Candlestick Patterns Indicator is a powerful technical analysis tool designed to help traders spot a wide variety of Japanese candlestick patterns on the chart. These patterns offer valuable insights into market sentiment and can signal potential trend reversals, continuations, or periods of weakness.

The indicator identifies over 30 distinct candlestick formations, including 1-bar, 2-bar, 3-bar, and multi-bar patterns. It visually marks them on the chart in a clear and attractive way, allowing traders to recognize important setups quickly and make more informed trading decisions.

Key features include detection of reversal and continuation patterns, non-repainting logic for reliable signals, and a multi-timeframe dashboard to monitor patterns across different timeframes. Alerts are also included to notify traders of newly formed patterns as they emerge.

While the indicator is capable of detecting a wide range of patterns, this can sometimes make the chart appear crowded. To address this, users can easily disable specific patterns through the input settings to maintain clarity and focus. Whether you're new to candlestick trading or looking to enhance your existing strategy, the PZ Candlestick Patterns Indicator offers a practical and customizable way to trade time-tested price action signals.

Supported Candlestick Patterns

- Break-Away (a.k.a Line Strikes)

- Fakey (a.k.a Hikkake)

- Counter Gaps

- Three Soldiers / Three Crows

- Hammers / Shooting Star / Hanging Man

- Engulfing

- Outside Up / Outside Down

- Harami

- Inside Up / Inside Down

- Morning Star / Evening Star

- Kickers

- Piercing / Dark Cloud

- Belt Hold

- Rising Three / Falling Three

- Tasuki Gap

- Side by Side Gap

- Windows

- Advance Block / Descend Block

- Deliberation

- Marubozu

- Squeeze Alert (a.k.a Master Candle)

- Dojis

Reversal Patterns

Break-Away (a.k.a Line Strikes) - This Candlestick Pattern could also be called Pump and Dump, and only differs from the Morning Star in the number of congestion bars present before the latest market participants are caught with their pants down. This particular formation might take place with or without gaps, and with or without breaking the low of the first bar.

Fakey (a.k.a Hikkake) - The Fakey Pattern indicators rejection of an important level within the market. The pattern consists of an inside bar followed by a false break and then a close back within its range. The entry is triggered as price moves back up past the high of the inside bar. The opposite applies in the bearish version.

Counter Gaps - Sometimes a gap becomes a sudden and explosive reversal, in which bulls or bears counter-attack and force other market participants to cover their positions. Several patterns are used to describe this situation, but the indicator blends all of them into one single pattern. This pattern has only one implication: you should trade the reversal and help the big hands to take down the price

Three Soldiers / Three Crows - A candlestick pattern that is used to predict the reversal of the current downtrend. This pattern consists of three consecutive long-bodied candlesticks that have closed higher than the previous day, with each session's open occurring within the body of the previous candle. Opposite for shorts.

Hammers / Shooting Star / Hanging Man - Hammer candlesticks form when a security moves significantly lower after the open, but rallies to close well above the intraday low. The Shooting Star is a single day pattern that can appear in an uptrend. It opens higher, trades much higher, then closes near its open. It looks just like a Hammer turned upside down, indicating that buyers are not willing to bid the price higher.

Engulfing - This reversal pattern consists of two candles. The first day is a narrow range candle that closes down for the day. The sellers are still in control of the stock but because it is a narrow range candle and volatility is low, the sellers are not very aggressive. The second day is a wide range candle that "engulfs" the body of the first candle and closes near the top of the range. The opposite applies in the bearish version.

Outside Up / Outside Down - This pattern is one of the more clear-cut three day bullish reversal patterns. The formation reflects buyers overtaking selling strength, and often precedes a continued rally in price. In fact up to day-two we have a bullish Engulfing pattern, itself a strong two-day reversal pattern, and this pattern emerges when we wait for confirmation.

Harami - When you see this pattern the first thing that comes to mind is that the momentum preceding it has stopped. On the first day you see a wide range candle that closes near the bottom of the range. The sellers are still in control of this security. Then on the second day, there is only a narrow range candle that closes up for the day. This pattern is not especially reliable, it is better to wait for confirmation using the Inside Up or Inside Down pattern.

Inside Up / Inside Down - This is a three-bar reversal pattern. Up to day-two we have a simple Bullish Harami pattern. Haramis give a clear-cut formation reflecting buyers overtaking the strength in the downtrend. This formation often precedes a continued rally in price. With just a Harami pattern, most candlestick analysts will usually wait for additional conformation before entering a long position. The Inside formation is that confirmation.

Morning Star / Evening Star - A three day bullish reversal pattern that is very similar to the Morning Star. The first day is in a downtrend with a long black body. The next day opens lower with a Doji that has a small trading range. The last day closes above the midpoint of the first day. The Morning Star is the basic anatomy of a sudden Pump and Dump operation in the market.

Kickers - Kickers are one of the most explosive and powerful reversal patterns. Like most candle patterns there is a bullish and bearish version. In the bullish version, the security is moving down and the last red candle closes at the bottom of the range. Then, on the next day, the stock gaps open above the previous day's high and close. This "shock event" forces short sellers to cover and brings in new traders on the long side. The opposite takes place in the bearish version.

Piercing / Dark Cloud - This is also a two-candle reversal pattern where on the first day you see a wide range candle that closes near the bottom of the range. The sellers are in control. On the second day you see a wide range candle that has to close at least halfway into the prior candle. Those that shorted the security on first day are now sitting at a loss on the rally that happens on the second day. This can set up a powerful reversal.

Belt Hold - A significant gap down occurs. The remaining price action for the day occurs to the upside. This triggers a buying spree. Shorts cover their positions due to concern over this price action. The opposite applies in the bearish version. This pattern has only one implication: you should trade the reversal and help the big hands to take down the price.

Continuation Patterns

Rising Three / Falling Three - A bullish continuation pattern in which a long white body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new high and forces bears to cover their shorts. The opposite applies in the bearish version. This is one of the most reliable continuation patterns available. The PZ Candle Patterns indicator can recognize rising and falling patterns of multiple bars in length.

Tasuki Gap - A continuation pattern with a long white body followed by another white body that has gapped above the first one. The third day is black and opens within the body of the second day, then fills in the gap between the first two days, but does not close the gap. This suggests that the uptrend will continue and might be a good time to get into the market at a good price. The opposite applies in the bearish version.

Side by Side Gap - A continuation pattern with a long white body followed by another white body that has gapped above the first one. The gap might be closed or not, but two bullish days announce that the market is inclined to climb higher. This pattern is much more effective if the third day closes above the second day's high. The opposite applies in the bearish version.

Windows - The same as a Western gap. Windows are continuation candlestick patterns. When the market opens a window to the upside, it is a rising window. It is a bullish candlestick pattern and the rising window should be support. There is much psychology behind windows. Gaps can act as resistance or support. The trend might continue strongly or it might fill the gap first. The market can also reverse right after a gap.

Weakness Patterns

Advance Block / Descend Block - This formation is similar to the Three Soldiers formation. However, the Advance Block chart alerts traders to the weakness of the upside price action since the close of the second and third days are significantly less than their highs, each bar having a smaller body and longer upper wick than the preceding one. The opposite applies in the bearish version. A variation of this pattern, also recognized, is Three Stars in the north and Three Stars in the south, which only difference is that each bar makes a lower high than the previous one.

Deliberation - This formation is very similar to the Advance Block and Descend Block patterns. The key difference is that all of the weakness shows up on the third day. The first two days have powerful upward moves. The quick change in sentiment opens the window for daytraders to initiate shorts or capture profits. This pattern is not very reliable, but it certainly sets the mood for a convincing reversal pattern in the future.

Neutral Patterns

Marubozu - The Marubozu takes place when a security has traded strongly in one direction throughout the session and closed at its high or low price of the day. A marubozu candle is represented only by a body; it has no wicks or shadows extending from the top or bottom of the candle. The white marubozu candle indicates that buyers controlled the price of the stock from the opening bell to the close of the day, and is considered very bullish. The opposite applies in the bearish version.

Squeeze Alert (a.k.a Master Candle) - Just as its name suggests, the squeeze alert pattern should be treated as a valuable alert signal that the market is in for a swift and dramatic change of direction. This three candlestick formation rarely occurs, but when it does you should immediately tighten your stoploss and trade the next breakout of the master candle when it takes place.

Dojis - The doji is probably the most popular candlestick pattern. The stock opens up, goes nowhere throughout the day and closes right at or near the opening price. Quite simply, it represents indecision and causes traders to question the current trend. Several dojis and other indecision patterns together usually mean that a squeeze is coming, and are useful to detect congestion zones. Variations like Long Legged Doji, Dragonfly Doji, Gravestone Doji and stars are not worth detecting, since their trading implications are not much different.

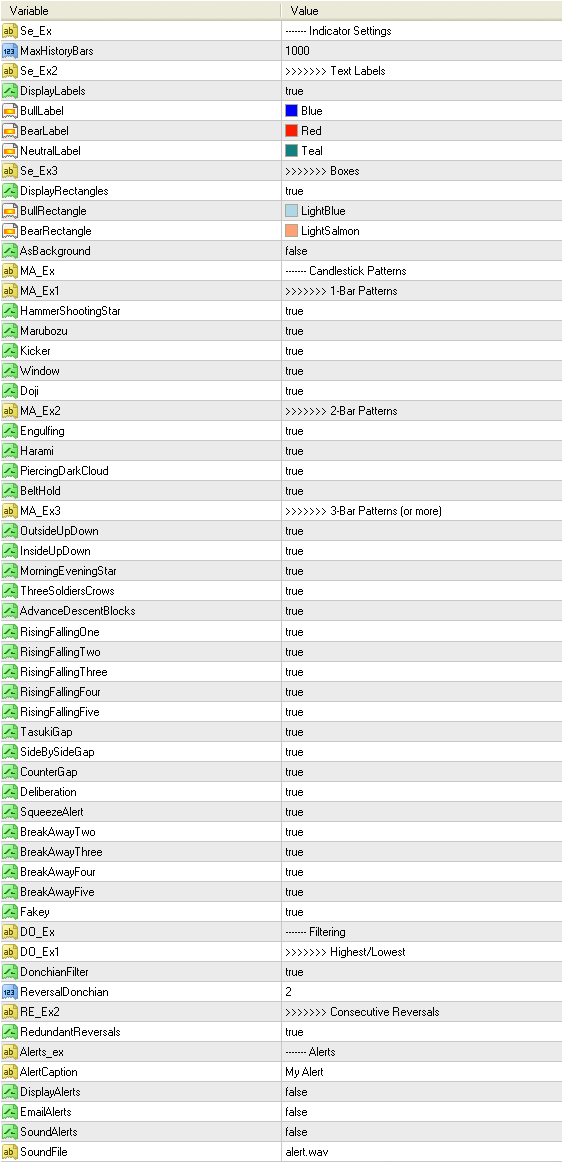

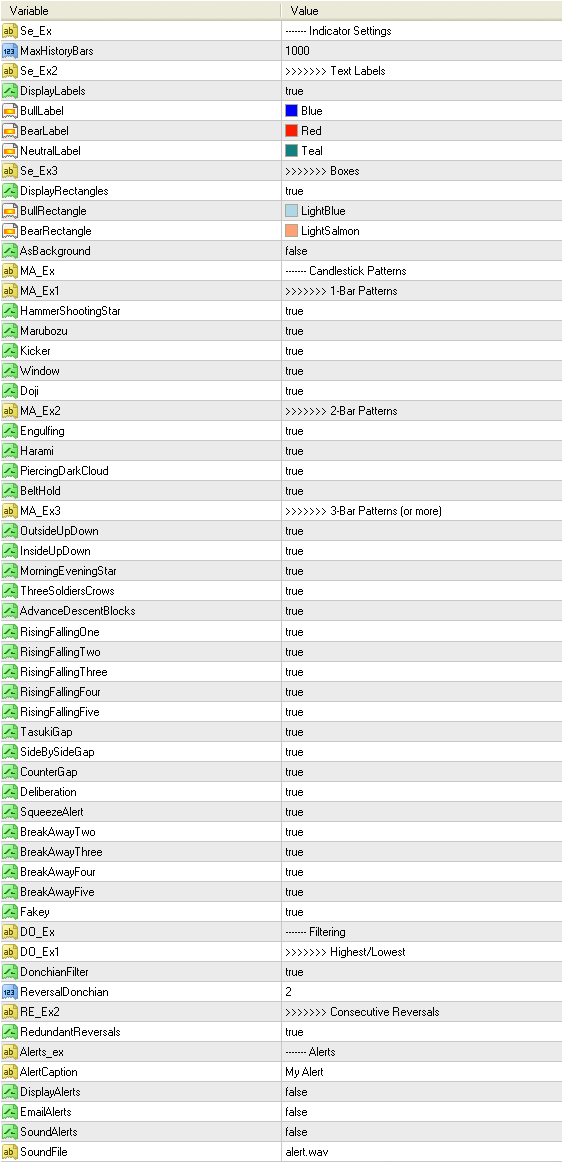

Input Parameters

- PaintBars - Switch on/off the highlighting of patterns using the color of the bars

- DisplayLabels - Show or hide text labels displaying the name of the recognized patterns

- BullLabel / BearLabel - Choose the color of the text labels for bullish and bearish patterns

- DisplayRectangles - Show or hide boxes surrounding the recognized patterns

- BullRectangle / BearRectangle - Choose the color of the rectangles for bullish and bearish patterns

- 1-Bar Patterns - Switch on/off recognition of 1-bar patterns one by one.

Hammers, Shooting Stars, Marubozus, Kickers, Windows and Dojis. - 2-Bar Patterns - Switch on/off recognition of 2-bar patterns one by one.

Engulfing, Harami, Piercing, Dark Cloud and Belt Hold. - 3-bar Patterns - Switch on/off recognition of 3-bar patterns and beyond.

Inside Up, Inside Down, Morning Star, Evening Star, Three Soldiers, Three Crows, Advance Blocks, Descend Blocks, Rising Three (and combinations), Tasuki Gaps, Side-By-Side Gaps, Counter Gaps, Deliberations, Squeeze Alerts, Fakey and Break-Away (and combinations). - DonchianFilter - This option only applies to reversal patterns. Since reversal patterns are only valid at the end of a trend, some kind of condition must be placed to display or ignore certain patterns. A Donchian Filter allows us to filter any reversal pattern using the highest/lowest of the desired last number of bars. The default behavior is to ignore bearish reversal patterns below the highest of the last four bars, and ignore bullish reversal patterns above the lowest of the last four bars. This parameter allows you to switch on/off this filter.

- ReversalDonchian - The desired number of bars to evaluate in order to display or ignore reversal patterns. (Only applies if the above option is enabled)

- RedundantReversals - Reversal patterns often take place one after another as the market turns its direction, signaling the reversal more than once as the price evolves. For example, it is frequent to see reversals very similar to the following. A Bullish Hammer (Bar 1), followed by an Engulfing Pattern (Bar 2), an Outside Up Pattern (Day 3) and Three Soldiers (Day 4), being all of them redundant reversal patterns after the first hammer took place. If disabled, the RedundantReversals parameter eliminates this redundancy and hides future reversal patterns in the same direction after the first valid one. This feature is very useful if you are visually backtesting charts but not so much for live trading, since you want to receive as many signals as possible -or perhaps didn't trade the first hammer-. Make sure to enable this option for live trading, in order to see all opportunities and receive alerts.

- Alerts - Enable alerts, email alerts and/or sound alerts for the patterns enabled above.