Triangular Arbitrage 15.3

Metatrader Expert Advisor (MT4/MT5)

-

ℹ Overview

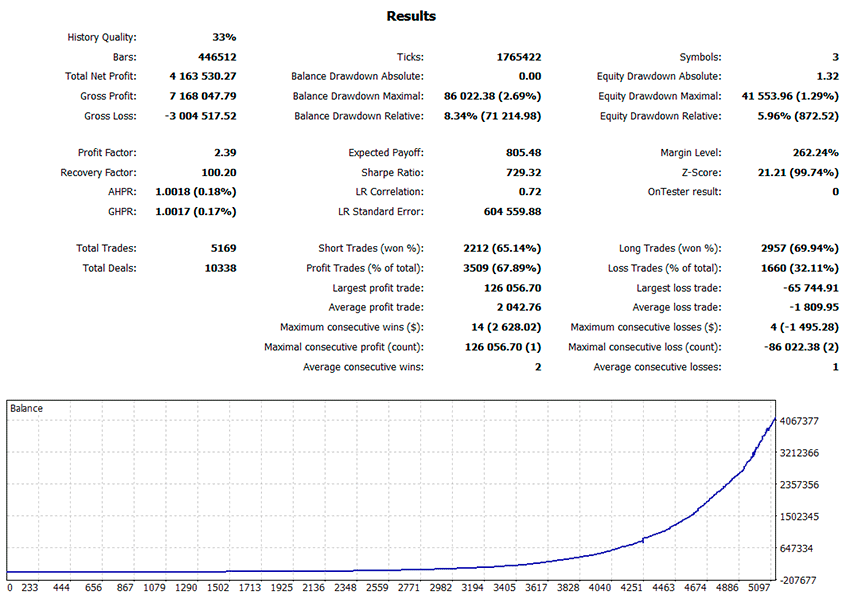

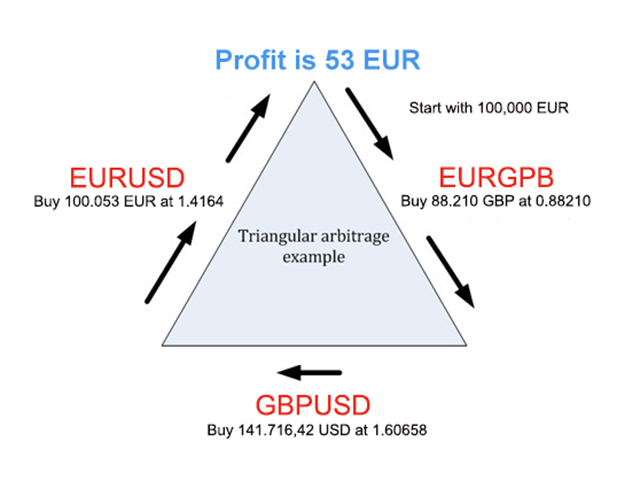

PZ Triangular Arbitrage EA is a forex trading software that is designed to exploit inefficiencies between three related currency pairs. The strategy behind this software is known as triangular arbitrage. Triangular arbitrage is a trading strategy that involves three offsetting transactions, exchanging one currency for another, then the second currency for a third, and finally the third currency back to the original. The aim is to lock in a risk-free profit from a discrepancy in exchange rates.

For example, consider the currency pairs of USD, GBP and EUR, the software can be used to trade the currency pairs EUR/USD, GBP/USD and EUR/GBP. The calculation formula for this triangular arbitrage strategy is as follows:

MEAN = EURUSD - EURGBP * GBPUSD

The mean roughly centers around zero but at times has serious excursions from this value. A mean below zero means that a profit is possible buying EURUSD, selling EURGBP and hedging with GBPUSD. Likewise, a mean above zero means that a profit is possible selling EURUSD, buying EURGBP and hedging with GBPUSD. If the combined transaction costs are smaller than the discrepancy, the deal can be taken and profits can be made.

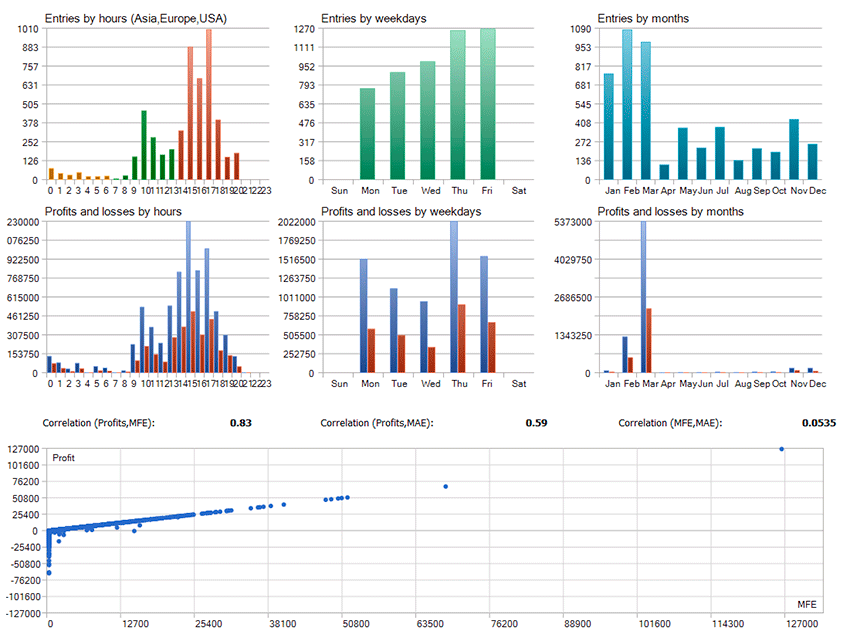

The software has 25 built-in pair rings and also allows the user to enter their desired pair ring. The software adapts to various factors such as spread, commission, and slippage, making it a flexible solution for traders.

The software also has various features such as the possibility to hedge or not to hedge, customizable trading weekdays and hours, customizable trade trigger and profit target, and customizable leverage and risk. The software is NFA/FIFO compliant, making it suitable for use with USA brokers.

In case of high slippage, the software will handle the deal as a mean reversion deal using only the first two pairs, which is still likely to be profitable. With PZ Triangular Arbitrage EA, traders can easily set up and supervise their trades and take advantage of forex, crypto and metal pair rings. The software is also time-frame independent.

Benefits

- Easy to set up and supervise

- Trade forex, crypto and metal pair rings

- Adapts to spread, commissions and slippage

- The strategy is time-frame independent

- It implements 25 built-in pair rings

- A theoretical zero risk strategy

- NFA/FIFO compliant

Features

- 25 built-in pair rings or...

- Enter your desired pair ring in inputs

- Possibility to hedge or not to hedge

- Customizable trading weekdays and hours

- Customizable Trade Trigger and Profit Target

- Customizable leverage and risk

The EA adapts its behavior to slippage. If the broker incurrs into considerable slippage when filling first two orders of the deal, the EA will refrain from hedging thus locking-in a loss in the ring. Instead, it will handle the deal as a mean reversion deal using only the first two pairs, which is still very likely to be profitable.

Usage Tips

- Trade with an "instant execution" broker

- Trade from a VPS or a good network point

- Backtest the MT5 version in M1 HLOC/Every Tick with random delay

- In netting accounts: don't trade rings with overlapping pairs simultaneously.

- In hedging accounts: trade many rings at the same time without restrictions.

- Changing the magic number from pair ring to pair ring is not necessary

Built-in Pair Rings

- EURUSD / EURGBP / GBPUSD

- EURAUD / EURGBP / GBPAUD

- EURNZD / EURGBP / GBPNZD

- EURCHF / EURGBP / GBPCHF

- EURCAD / EURGBP / GBPCAD

- EURJPY / EURGBP / GBPJPY

- EURJPY / EURUSD / USDJPY

- EURCHF / EURUSD / USDCHF

- EURCAD / EURUSD / USDCAD

- EURUSD / EURAUD / AUDUSD

- EURCAD / EURAUD / AUDCAD

- EURJPY / EURAUD / AUDJPY

- EURCHF / EURAUD / AUDCHF

- EURNZD / EURAUD / AUDNZD

- GBPUSD / GBPAUD / AUDUSD

- GBPCHF / GBPUSD / USDCHF

- GBPCAD / GBPUSD / USDCAD

- AUDCAD / AUDUSD / USDCAD

- AUDUSD / AUDNZD / NZDUSD

- AUDCHF / AUDUSD / USDCHF

- EURUSD / EURNZD / NZDUSD

- NZDCAD / NZDUSD / USDCAD

- NZDCHF / NZDUSD / USDCHF

- NZDJPY / NZDUSD / USDJPY

- GBPJPY / GBPUSD / USDJPY

- AUDJPY / AUDUSD / USDJPY

The EA can trade any pair ring of your choosing, including metals and crypto currencies. Examples of crypto currency rings are BTCUSD / BTCEUR / EURUSD and BTCETH / BTCBCH / BCHETCH. Examples of metal rings are XAUUSD / XAUEUR / EURUSD and XAUJPY / XAUUSD / USDJPY.

Trading Guidelines

- Minimum deposit: 5,000$

- Suitable instruments: Forex and Crypto

- Suitable timeframes: Timeframe is irrelevant for this robot because it uses tick data only.

- ≡

Input parameters

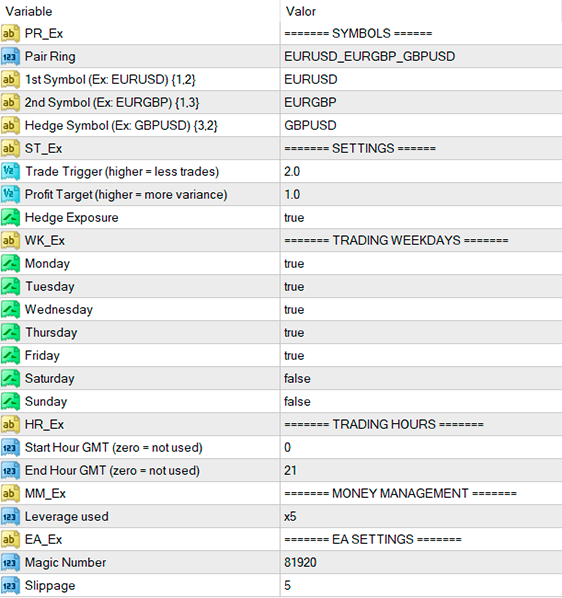

When loading the expert to any chart, you will be presented with a set of options as input parameters. Don't despair if you think they are too many, because parameters are grouped into self-explanatory blocks.

- Pair Ring

- Select a built-in pair ring to trade or select "Manual Inputs".

- 1st Symbol

- The first symbol of the pair ring. For example, EURUSD.

- 2nd Symbol

- The second symbol of the pair ring. For example, EURGBP.

- Hedge Symbol

- The hedge symbol of the pair ring. For example, GBPUSD.

- Trade Trigger

- The minimum price discrepancy to trade in pips. A higher trigger will cause less trading frequency.

- Profit Target

- The profit target for the deals in pips. A higher profit target will cause more variance in trading results.

- Hedge

- Enable or disable hedging of the deals. Deals can also be profitable without hedging and transaction costs are smaller.

- Trading Weekdays

- Enable or disable trading on any given weekday, from monday to sunday.

- Trading Hours

- Set the trading hours for the EA. By default it trades from 00 to 21 hours.

- Leverage

- elect the leverage the EA must use when trading the pair ring.

- Slippage

- Maximum slippage on orders in points.

- ?

FAQ

- Can I choose what pairs to trade?

- Yes, the EA has a drop

- Can I trade a custom pair ring of my choosing?

- Yes, the EA has three inputs for you to type these pairs.

- Can I trade crypto currencies?

- Yes, you can. For example you can trade the ring BTCUSD / BTCEUR / EURUSD.

- Can I trade metals?

- Yes, you can. For example you can trade the ring XAUUSD / XAUEUR / EURUSD.

- What happens if the EA gets heavy slippage?

- If the slipage of the first two trades render the theorical profit moot, the EA will refrain from hedging the deal and handle the trades as a two

- Does the EA trade very often?

- In strictly forex pairs, not very often. But in metals and crypto, far more often.

- The EA does not trade in the tester!

- Right, it does not. At the time of writing, Metatrader4 does not support multi

- Is Triangular Arbitrage NFA FIFO compliant?

- Yes, it is!